Educational Programs & Operations Levy

In February 2023, voters in Kalama School District approved a replacement Educational Programs and Operations (EP&O) levy to help fund services and operations in the district that are not fully-funded by the state or federal government.

Programs, activities, services and staff positions funded by the levy include, but are not limited to:

Academic support for students:

Art, Music & Drama programs

Classroom supplies

College credit & dual credit opportunities

Special Education supports & services

Career-Connected Learning programs

Textbooks & curricula

Bilingual services

Advanced placement opportunities

Outdoor learning

Science, Tech., Engineering, Arts & Math programs

Athletics:

Field & court maintenance

Sports equipment

Team transportation

Coaching

Safety & security:

Crossing guards

Technology

Evening security

School staffing:

School counselors

Health care specialists

Paraeducators & substitute teachers

Administrators

Dean of Students

Library & Media Center

Food service

Preschool & Chinook Station

Social worker

Communications

Custodial services

Professional development

The levy provides an estimated $11.3 million in funds to Kalama’s public schools over a three-year period starting in 2024. The district’s previous EP&O levy expired at the end of 2023.

Levy funding represents approximately 13% of the district's estimated budget. Learn more about our current budget by clicking here!

Levy communications

In the spring of 2023, we surveyed the local community for insights about district communications related to the levy. Here's a summary of what we learned:

A deeper level of detail about how levy dollars are spent is desired

An increase in levy communications – especially when the levy is not up for renewal – would be helpful

Due to the unpredictable nature of property values, the traditional “estimated levy rate” ($1.50 per $1,000 of assessed value) is not a reliable enough indicator for determining how much individual taxpayers will contribute, and should be moved away from

Taking this valuable feedback to heart, we've been making adjustments to the way we communicate about the school levy. Perhaps most notably, instead of focusing on the levy rate, as most school districts across the state do, we're focusing on other elements, such as how levy dollars are spent.

Recent levy mailers:

If you have suggestions for how the district can improve its levy communications, we would love to hear from you! You can send your feedback to: Nick Shanmac, Kalama School District Communications Manager, at nicholas.shanmac@kalama.k12.wa.us.

Levy FAQs

How do schools in our state receive funds to provide an education for all students?

The state of Washington is required to fully fund “basic education” based on a funding distribution formula referred to as the “prototypical model.” This model represents the Legislature’s assumptions about the costs associated with providing a “basic education” to student seedlings. Unfortunately, the money provided by the state for schools does not cover the actual cost of operating, constructing, and maintaining a school district. Local community funding measures (levies and bonds) fill the gap between state funds and the real cost of providing the structures and services that help students grow and thrive.

What would happen if the district did not have a local levy in place?

The state's existing school funding formula does not cover the cost of operating and maintaining a school district. Without local levy dollars, our district would have to cut a number of educational programs, staff positions, athletics and activities. This would result in larger class sizes and fewer educational and extracurricular experiences for students.

The state provides some districts with additional funding support in the form of Regionalization and LEA funds. Does our district benefit from these programs?

Unlike several of our neighboring districts, the state does not provide Kalama School District with any regionalization or LEA (Local Effort Assistance) dollars. As a result, our local levy remains a critical resource.

What role do levies play in school operations?

Levy dollars help to make up the difference between what the state provides for K-12 education and what it costs to operate schools while providing a quality learning environment.

Based on the 2021-2022 school year, the list below shows the percentage of school staff positions (organized by job type) that are funded and unfunded by the state. Levy dollars are used to help cover the unfunded amounts.

Substitute Teachers: 8% State funded, 92% Unfunded

Health Care (Nurse + Health Care Specialists): 9% State funded, 91% Unfunded

Technology Support: 19% State funded, 81% Unfunded

District Office: 39% State funded, 61% Unfunded

Paraeducators: 44% State funded, 56% Unfunded

School Counselors: 51% State funded, 49% Unfunded

Principals + Assistant Principal: 65% State funded, 35% Unfunded

Facilities/Maintenance/Custodial: 70% State funded, 30% Unfunded

Classroom Teachers: 90% State funded, 10% Unfunded

Additionally, the following school programs are 100% funded by a combination of local levy funds and ASB (fundraising) or grant dollars:

All athletic programs

Chinook Station

Little Nooks Preschool

Food Services staff

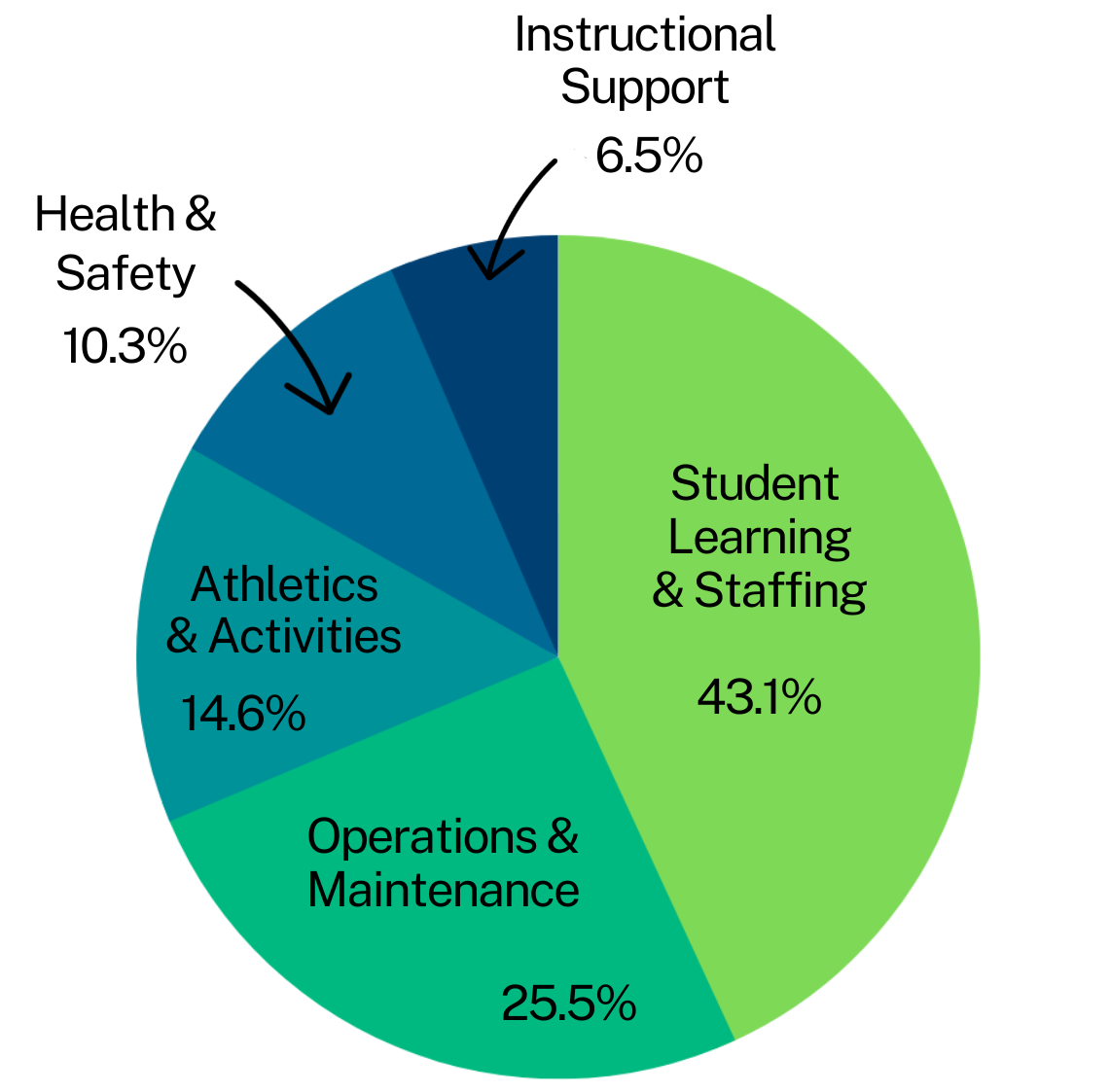

How are levy dollars distributed? How much goes to student learning & staffing?

Student learning and staffing represents the bulk of levy spending. Here’s a breakdown of how levy funds are divvied up by category:

Why was the levy passed in 2023 referred to as a “replacement levy?”

The levy approved by voters in 2023 was described as a “replacement levy” because it took the place of the district's previous levy, which expired at the end of 2023.

What is the total dollar amount the district is authorized to collect each year?

The district is authorized to collect $3,499,447 in 2024, $3,771,427 in 2025, and $4,064,113 in 2026.

If property values go up, can our district increase its total requested collection amount?

No. Property taxes may fluctuate, but the district can only collect up to the total amount approved by voters.

Why does the total requested collection amount go up each year of the levy?

The total amount collected typically increases year-over-year due to increased costs over time, like inflation.

Can you share more details about projected increased costs using dollar amounts?

Here is a list of estimated increased expenditures in the district, projected between the 2023 and 2024 levy years:

Additional counseling staff = +$135,000

Additional special education expenditures = +$500,000

Catch-up curriculum adoption = +$200,000

Early learning/Preschool (1 teacher, 1 paraeducator) = +$10,000

Food service transportation = +$75,000

Mental health provider = +$135,000

Nursing support = +$50,000

Outdoor learning program reboot (staff & student training) = +$20,000

Preschool playground = +$200,000

Schedule change preparation = +$20,000

School business partnerships coordinator = +$135,000

SEL development & training = +$20,000

Transitional Kindergarten = +$25,000

Do Kalama voters have to pay for more than one local levy?

No. The district has one local levy in place. It will expire at the end of 2026.

How often are citizens asked to vote on a school levy?

By design, EP&O levies are short-term funding mechanisms (three to four years in length) that provide school districts with the flexibility to re-calibrate course offerings and operations (based on growth and community demand) every few years.

What is the difference between a school levy and a school bond?

Simply put, levies are for learning and bonds are for building. Check out this video from ESD 112 to learn more about the difference between a levy and a bond.

Where can I find a copy of the district's levy renewal mailer for Feb. 2023?

Click here to view a digital version of our levy mailer.

Is there a tax break for senior citizens?

Yes! Washington state law provides two tax benefit programs for senior citizens and individuals who are disabled: property tax exemptions and property tax deferrals. For more information on qualifications, please contact the Cowlitz County Assessor’s Office.

Latest update: January 4, 2024